Online Presence that Helps in

Profitable Growth on Amazon

Trusted By

Our Vision, Your Growth

Do you want to convert your small business into an international business brand ? We are here to help you achieve it. AMZSparks, Provides amazon account management services, That driven by a vision to establish itself as the gold standard. For us, your growth is the yardstick of our success. As the e-commerce world evolves, we’re right beside you, ensuring you’re always a step ahead.

Happy Client Review

Words that Inspire. A Client Testimonials Speak Louder Than Words! See What Our Clients Have to Say About Their Experience!

Brands Managed

Projects Completed

Numbers that Speak for Themselves

REVENUE GENERATED

SUCCESS RATIO

Our Successful Case Studies

Dive deeper into our case studies to discover the strategies that propel brands on Amazon platform.

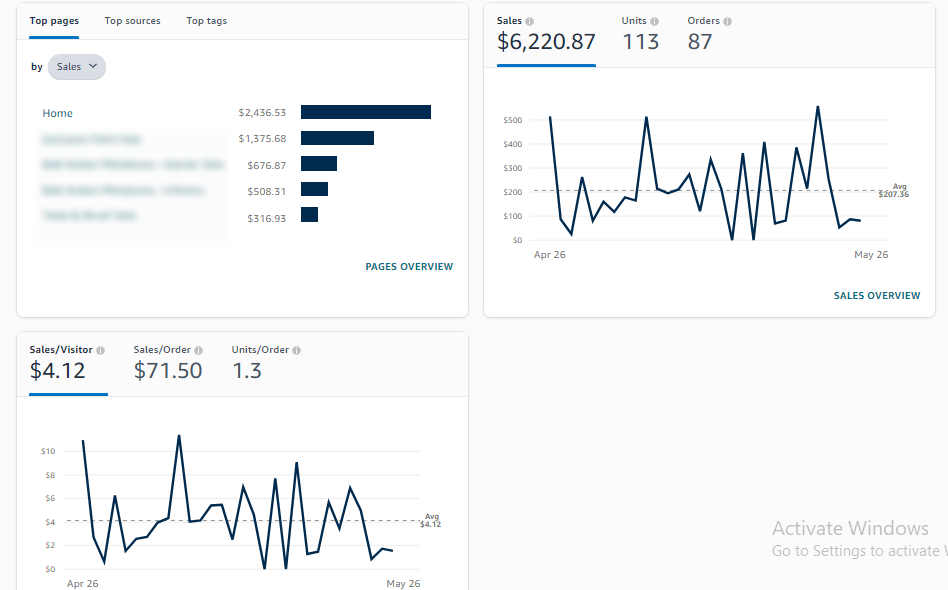

Catalog Case Study

A well-organized catalog is the backbone of any successful Amazon storefront. In this particular Amazon case study, we collaborated with a brand that struggled with product discoverability. By restructuring their catalog, optimizing product descriptions, and implementing A+ content, we transformed their listings into high-converting sales pages. The end result? Improved search rankings and a surge in organic sales.

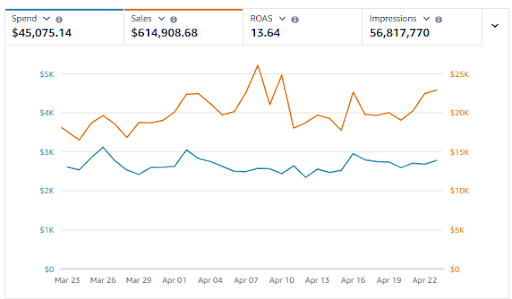

Amazon PPC Case Study

In one of our most enlightening amazon case study, we embarked on a mission to supercharge a client’s Pay-Per-Click (PPC) campaigns. Initial assessments painted a picture of untapped potential. By leveraging strategic keyword placements, bid adjustments, and comprehensive Amazon Performance Reviews, we managed to boost their ROI exponentially. The client’s products not only gained visibility but also saw a significant uptick in conversions, all while maintaining an optimal ACoS.

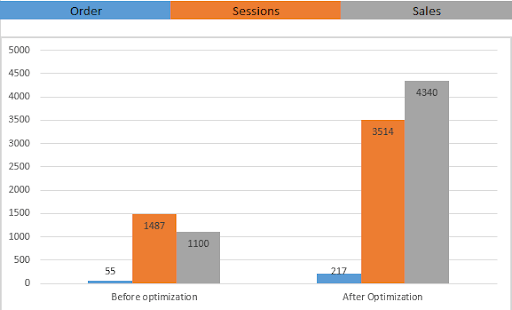

Amazon product listing Case Study

Every Amazon seller knows the challenges of launching a new product. In this Amazon Success Story, our strategies centered around the ‘Launch & Rank’ philosophy. Employing a combination of aggressive PPC campaigns, deal promotions, and leveraging early reviewer programs, we ensured the product quickly climbed the ranks. This Amazon Performance Review revealed a spike in initial sales, setting the foundation for sustained organic growth.

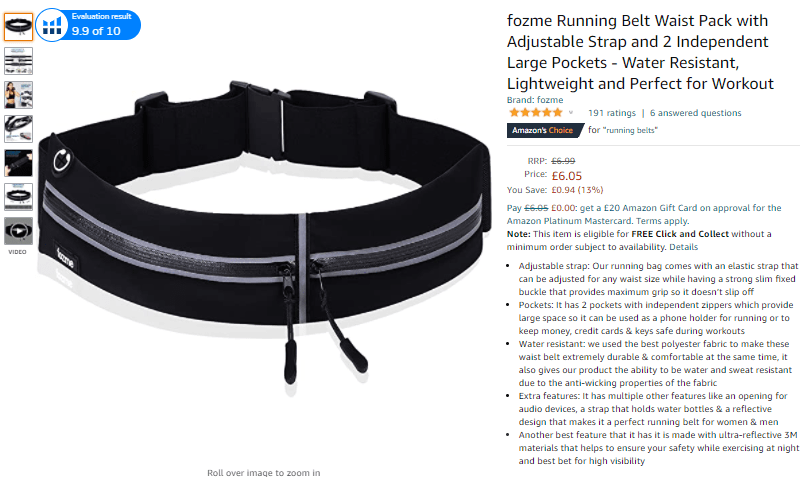

Amazon Brand Management Case Study

Brand management on Amazon goes beyond just product listings. Our engagement with a fledgling brand looking to establish its footing stands as a testament. Through meticulous brand positioning, competitor analysis, and leveraging Amazon’s Brand Registry benefits, we carved a niche for the client. This Amazon Success Story is one of holistic brand growth, where the brand not only witnessed increased sales but also garnered loyal customer advocates.

Our Services

Exceptional Amazon Account Management Services, tailored for you. Elevate your experience with Our Exclusive Offerings

Review

Clients' Testimonials

We worked with Sheraz and his team for the better part of a year and it was a pleasure to do so. He always did his best to deliver on what we asked for and was great with any feedback/changes we requested. Would highly recommend.

Do you want to convert your small business into an international business brand?

We are here to help you achieve it. Let’s transform your local success into international recognition! Expand your horizons, reach new markets, and make a global impact with our Account Management Services

Why Choose Our Amazon Marketing Services?

Warning: Undefined array key "icon" in /home/amzsmxlp/public_html/wp-content/plugins/elementor/includes/widgets/icon-box.php on line 695

Warning: Undefined array key "icon" in /home/amzsmxlp/public_html/wp-content/plugins/elementor/includes/widgets/icon-box.php on line 708

Custom-Tailored Strategies

At our amz marketing, we recognize and celebrate the uniqueness of each brand. Employing a meticulously crafted, bespoke approach, our team zeroes in on precisely what your brand needs. The outcome? A strategy that fits like a glove, driving unparalleled results.

Warning: Undefined array key "icon" in /home/amzsmxlp/public_html/wp-content/plugins/elementor/includes/widgets/icon-box.php on line 695

Warning: Undefined array key "icon" in /home/amzsmxlp/public_html/wp-content/plugins/elementor/includes/widgets/icon-box.php on line 708

Depth of Experience

Founded by a cadre of seasoned e-commerce specialists, we've set benchmarks in the realm of listing optimization and expensive strategies, with the results speaking for themselves with our Amazon Marketing Services

Warning: Undefined array key "icon" in /home/amzsmxlp/public_html/wp-content/plugins/elementor/includes/widgets/icon-box.php on line 695

Warning: Undefined array key "icon" in /home/amzsmxlp/public_html/wp-content/plugins/elementor/includes/widgets/icon-box.php on line 708

Data-Driven Results

Our amz marketing approach is grounded in data, guaranteeing results that resonate. Whether it's Catalog Management or pinpointed PPC strategies, we're all about maximizing your return on investment.

Warning: Undefined array key "icon" in /home/amzsmxlp/public_html/wp-content/plugins/elementor/includes/widgets/icon-box.php on line 695

Warning: Undefined array key "icon" in /home/amzsmxlp/public_html/wp-content/plugins/elementor/includes/widgets/icon-box.php on line 708

Strategic A+ Content Management

With specialized A+ Content Managers, we optimize product listings, marrying aesthetics with information. Improve your engagement and conversion with enhanced visuals and strategic content.

Bring Innovation to Your Company

Explore our Client Onboarding Process – where efficiency meets excellence. Your success story begins here

Frequently

Asked Questions

Absolutely! We encourage clients to schedule consultations to discuss their specific needs, goals, and to develop a personalized strategy that aligns with their business objectives.

Our team employs proven strategies to optimize your product listings, focusing on keywords, and compelling product descriptions. optimizing and scaling PPC. This approach aims to improve visibility, click-through rates, and conversions.

Amzsparks offers a range of services tailored for online sellers, including catalog management, listing optimization, advertising management, and brand management. We work to enhance your brand presence and boost sales on the e-commerce platforms.

Yes, at Amzsparks, we have worked with sellers across various niches. Our team's diverse experience allows us to tailor strategies to the unique challenges and opportunities within your niche.

Amzsparks stands out through its commitment to results. We guarantee a revenue increase of up to 20% within 45 days or we won't charge you until this happens. Our personalized approach, data-driven strategies, and experienced team contribute to our clients' long-term success.

Getting started is easy! Simply reach out to our team through our contact form or schedule a free consultation call. During this call, we'll discuss your specific needs, and goals, and how our services can benefit your Amazon business and the next onboarding steps.